1. Provide a bit of background on Michael Taylor

My passion for the sciences, healthcare and drug discovery is reflected in my education and my career. I received a Master’s in Science from Johns Hopkins in biotechnology while working as a research scientist in drug development gene therapy research for GenVac (acquired by Precigen, Inc). There, we brought two products to clinical trials and characterized a cell line for the FDA that became the base for Johnson & Johnson’s Covid-19 vaccine.

I attended the University of Rochester MBA program to transition to finance. I’ve now been investing in healthcare for 20 years, initially at Oppenheimer Funds as head of healthcare, followed by Caxton, Diamondback, Citadel and Millenium (where over the last 10 years I’ve progressed from analyst to PM, to PM of a large book, to PM of the largest book).

2. What drives your interest in doing PINK – especially for free?

I am great friends with the team at Simplify. They approached me about launching a health care fund that would donate all profits to Susan G. Komen, and I just loved the idea. It was an innovative kind of impact investing I had not seen before.

Everyone is touched by cancer either directly or through friends and family. This is a unique opportunity for me: to translate investing skills developed in hedge funds to the long only world; to give back in a meaningful way to an exceptional cause; and to access the resources of Susan G. Komen and Simplify for the benefit of investors. To my knowledge, there’s nothing else like this in the market today.

3. How do you think about the transition to long only from hedge fund?

In my opinion, investing is a lot easier when shorting stocks is not part of your mandate. Clearly, shorting can be dangerous, particularly in the current market. By nature, groundbreaking/innovative companies can be volatile, but in a levered hedge fund, volatility is unacceptable. With so much focus on minimizing portfolio volatility, 70% of mental load in hedge funds is on shorts. With the PINK strategy, we can focus on long opportunity in biotech, MedTech, gene therapy, and other fast-growing areas within the health care sector, which is enormously refreshing!

4. “Everyone is touched by cancer”… what does this mean to you?

Today, it is an unfortunate rite of passage for being human. Everyone knows someone who has suffered or died from cancer. I truly believe that tomorrow can be another story. This is a disease that we’ll be able to treat and solve, much as we addressed diseases like smallpox and tuberculosis. It will just take more time and more money.

I believe PINK can be part of the solution. We seek to invest in companies that are at the cutting edge of finding cures. AND by supporting Susan G. Komen, an incredible organization that not only helps fund research, but also supports cancer patients and survivors while raising awareness about screening and early detection.

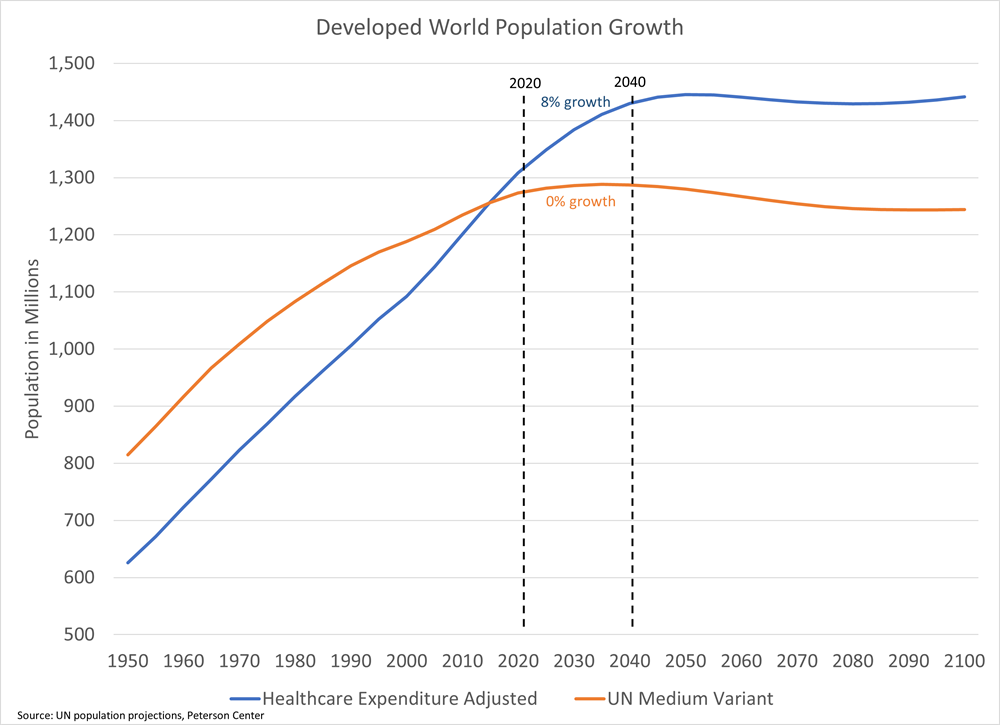

5. How do you think about the macro picture for healthcare?

The healthcare sector accounts for 17% of US GDP[1] and represents 13% of the S&P 500[2]. Over the next couple of decades, we expect healthcare to make up a larger percentage of GDP (in the US and around the world) as populations grow older and as longevity increases. The medical technology space in particular will benefit from the inevitable increase in demand for healthcare. Furthermore, we are at the cusp of some major breakthroughs in pharmaceuticals, diagnostics, and medical devices. Active management will be critical going forward. Despite demographics, many of the larger names in the healthcare space will be challenged with patent expiries and a dearth of prospects in their development pipelines.

6. What should investors expect from your portfolio?

The Simplify Health Care Fund seeks long-term capital appreciation by investing in U.S. healthcare companies. The strategy defines health care companies as companies included in the Global Industry Classification Standard health care sector of the MSCI “USA” IMI Healthcare Index. Anyone who is looking to obtain exposure to a sector with attractive growth potential relative to a passive benchmark should seriously consider the opportunity in PINK. The fund may also be suitable for investors that are looking to build a portfolio of impact investments that seek to allocate capital in an efficient manner while also providing an indirect charitable contribution to the Susan G. Komen foundation. Stock selection and sector tilts will result in a concentrated portfolio consisting of 50 to 100 names. The portfolio can span market capitalization levels with no capitalization or weight restrictions. We’re looking to own companies with high quality management, strong investment in research & development, high barriers to entry (including patents, distribution systems, etc), new product innovation, and/or superior corporate governance. We’re seeking above average expected growth rates in revenues and earnings, but are mindful of valuation.

7. Who should consider investing in the Simplify Health Care Strategy?

The Simplify Health Care Fund seeks long-term capital appreciation by investing in U.S. healthcare companies. Anyone who is looking to capture alpha in a sector with attractive growth potential relative to the MSCI USA IMI Healthcare benchmark should seriously consider the opportunity in PINK. The fund may also be suitable for investors that are looking to build a portfolio of impact investments that seek to allocate capital in an efficient manner while also providing an indirect charitable contribution to the Susan G. Komen foundation.

1cms.gov 2021, Centers for Medicare & Medicaid Services, https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

2S&P Dow Jones Indices, 2021, https://www.spglobal.com/spdji/en/indices/equity/sp-500/#data

GLOSSARY:

Alpha: a measure of performance, specifically, the excess return of an investment relative to the return of a benchmark index.

MSCI USA IMI Index: The MSCI USA Investable Market Index (IMI) Health Care is designed to capture the large, mid and small cap segments of the US equity universe. Indexes are unmanaged. It is not possible to invest in them directly.

Active Management: Active management refers to a portfolio management strategy where the manager makes specific investments with the goal of outperforming an investment benchmark index or target return.