Why Invest in the 2-Year Part of the Yield Curve Now?

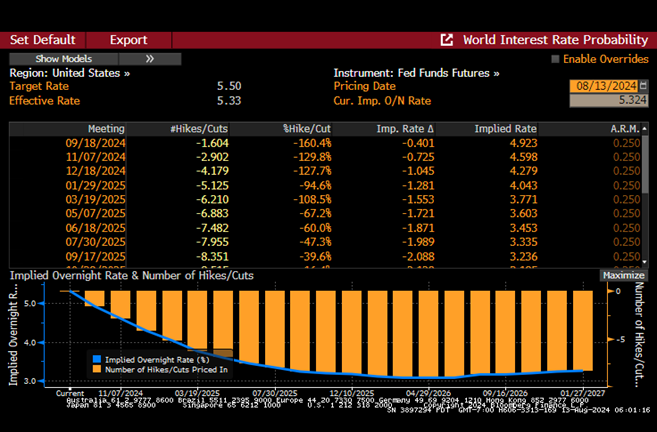

The Federal Reserve Bank (FED) left rates on hold at the July 31st meeting and they have now been on hold for over a year. However, they did lay the groundwork at this meeting for potentially cutting rates at the September meeting and after the July Jobs report came in weaker than expected it most likely will happen. The U.S. Treasury market is not waiting for the FED to make its move with 2-year U.S. Treasuries rallying about 30bps since the meeting and as you can see in Figure 1, almost two cuts (-40bps) priced into the market for the September meeting and over four cuts priced for 2024 (-105bps).

Figure 1: Interest Rate Probability

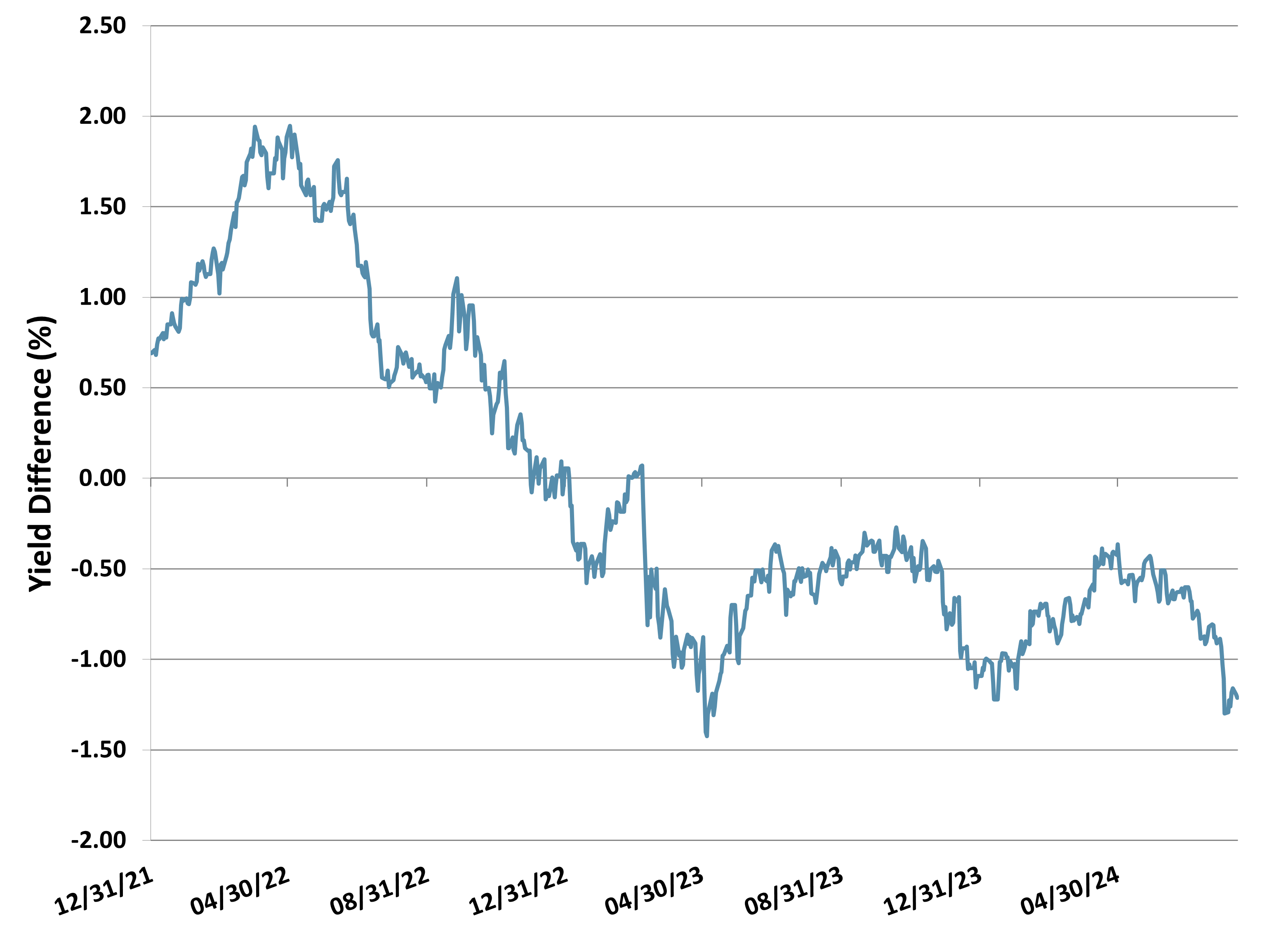

Although the 2-year U.S. Treasury yield recently dropped below 4.00% after peaking this year at the end of April at just over 5.00%, the Federal Funds effective rate is still 5.375%, thus 3-month and shorter T-Bills are yielding over 5.00%. This inverted curve (see Figure 2) has led to negative carry in the portfolio and has been a headwind this year. However, with the FED cutting rates soon this should lead to a return to a normal, upward-sloping yield curve allowing the 5 times exposure to the 2-year U.S. Treasury note to kick in for a tailwind.

Figure 2: U.S. Treasury 3-Month vs. 2-Year Curve

The Simplify Short Term Treasury Futures Strategy ETF (TUA)

TUA is a rather simple approach to investing in the front end of the yield curve sized in an amount that gives it intermediate Treasury duration. The ETF has about 5 times exposure to the 2-year U.S. Treasury Note, giving it a duration of about 8 to 9 years. The strategy combines a core portfolio of mostly U.S. Treasury Bills as collateral and actively traded 2-year U.S. Treasury futures contracts. TUA is systematically managed, which means that Simplify is not making any bets on the direction of interest rates, and futures contracts are rolled quarterly as they approach expiration.

In Conclusion

The 2-year part of the yield curve will benefit the most when the FED starts to ease monetary policy and TUA is a good option to express this idea. Even if the FED doesn’t cut as aggressively as the market is pricing, a gradual cutting cycle will still return the yield curve to a normal, upward sloping shape so now is a great time to consider exposure to 2-year U.S. Treasuries expressed in TUA.

GLOSSARY:

Basis Points: A common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

Duration: A measure of the sensitivity of the price of a bond to a change in interest rates.

Futures Contract: A legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. Futures contracts are standardized for quality and quantity to facilitate trading on a futures exchange.